Hi, I’m Teeka Tiwari.

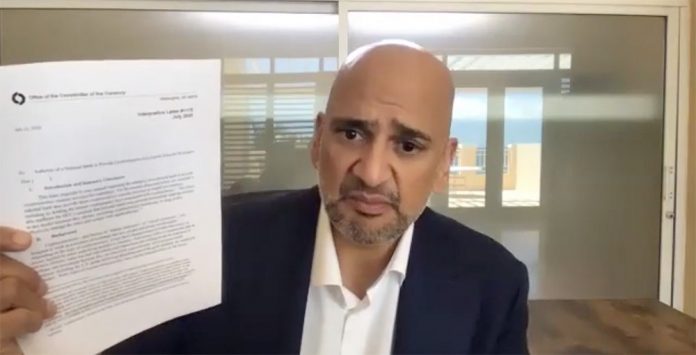

And right now I want you to grab a piece of paper and a pen… Because in just a moment, I’m going to give you the ticker symbol of what I believe will be the hottest investment of 2021. I’m gonna give it to you… no strings attached. Experts are already projecting this investment could rise as high as 1,530% by the end of the year. That’s 15 times your money. Unfortunately, most people will miss out. As Yahoo Finance wrote recently… “Retail investors are still mostly sidelined.” I don’t want you to be one of those people. I mean, this is just not fair. While everyday folks are in the dark, the savviest investors are investing untold amounts of money in this. That’s because the agency that regulates all banks in the U.S. has just announced a major change in this letter I’m holding in my hand. And it’s set to trigger a huge money shift. Raoul Pal, CEO of the advisory service Global Macro Investor, believes trillions will flow into this ticker. That’s why he already invested 75% of all his liquid assets in it.

He said: “It’s a once in a lifetime opportunity we’re being given. We get to front-run a wall of money. This is the biggest, best, single bet I’ve ever seen in my career of every asset I’ve ever looked at.”

Famous hedge fund manager Paul Tudor Jones is also betting big on this ticker. He already poured $183 million into this opportunity.. Out of all the investments in his portfolio, he says this “may end up being the best performer of all of them.” Better than all the stocks he already holds, like Google, Amazon, and Apple. He also said: “We’re in the first inning. It’s got a long way to go. [It’s like] investing in Google early.” Think about that… Had you invested $10,000 in Google when it went public, you’d have $363,200 today.

And Paul Tudor Jones is not alone. One River Asset Management has set up a fund that will invest about $1 billion in this one ticker. How crazy is that? Hedge fund manager Mike Novogratz has invested at least a whopping $700 million in this market.

He said: “Everyone should put 2% to 3% of their net worth in [this ticker] and look at it in five years. And it’s going to be a whole lot more.”

Wall Street legend Bill Miller, the founder of investment manager Miller Value Partners, also “strongly” recommends buying this ticker now.

He said: “I think every major bank, every major investment bank, every major high net worth firm is going to eventually have some exposure.”

Or look at another famous billionaire, Stanley Druckenmiller. He became famous after him and his partner George Soros famously “broke the Bank of England” when they shorted the British pound in 1992… And walked away with $1 billion in profits. Recently, he just announced he’s also invested in this ticker. It’s truly a mad rush right now. All the big players are getting in. In fact, institutions like hedge funds, pensions, and endowments are already pouring up to $400 million into this market… Every single week. Think about that… $400 million… every single week.